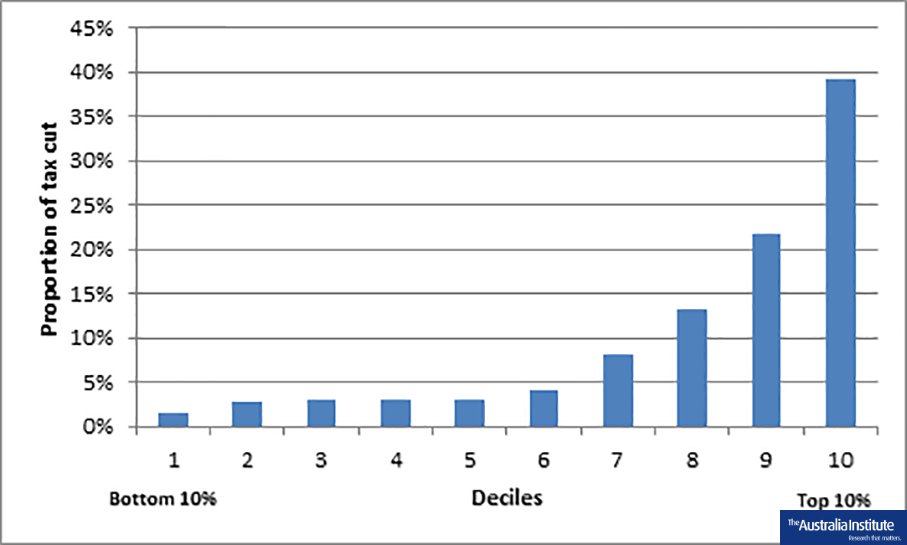

62% of tax cuts benefits go to highest income earners

Budget proposes Australia’s progressive tax system be overhauled to put majority of workers on the same tax rate.

[Report – see PDF below]

The Australia Institute has issued a briefing paper which modelled the distributionary effects of the proposal, showing the benefits flow overwhelmingly to the highest income earners who get 62%, while just 7% of the benefit goes to the 30% of Australians on the lowest wages.

Someone earning $40,000 per year will get a tax cut of $455 per year while someone earning $200,000 will get a tax cut of $7,225 per year. Some might say that of course someone on $200,000 will get a bigger cut; after all they pay more tax. But someone on $200,000 earns 5 times more than someone on $40,000. But their tax cut is 16 times larger.

“Using the latest taxation statistics we constructed a model of the tax and the distribution. It shows how inequitable this tax plan is,” Senior Economist at The Australia Institute, Matt Grudnoff said.

“Inequality is the economic issue of our time. Even groups like the IMF and World Bank are warning of the detrimental effects of inequality, including hampering economic growth.

“At a time when Australia is suffering record low wages growth and historically high inequality the government has proposed a radical plan to increase inequality,” Grudnoff said.

Related research

General Enquiries

Emily Bird Office Manager

Media Enquiries

David Barnott-Clement Media Advisor