Budget repair for the poorest, tax cuts for the wealthiest

As Prime Minister Malcolm Turnbull prepares to deliver an address regarding ‘budget repair’ his government is proposing unprecedented austerity for the poorest Australians but generous tax cuts for the wealthiest companies and individuals.

At the heart of the PM’s plan to repair the Commonwealth Budget is a plan to slash the budgets of Australia’s poorest households. The proposed removal of the clean energy supplement would cut $8.80 a fortnight from Newstart and $14.10 from the single age pension.

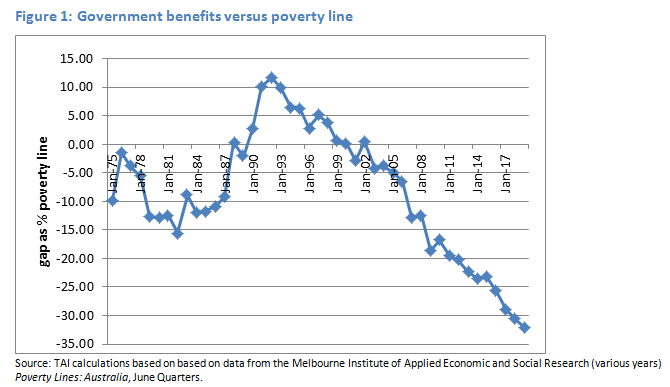

Unemployment rose and wage growth stagnated under the last term of government. Newstart allowance for the unemployed has now sunk to a record low, nearing 30% below the long established Henderson Poverty Line (see figure 1 below).

“It’s quite remarkable to see a government looking to pay for lavish tax cuts to corporations by taking from the poorest, who are doing it tougher than at any point on record,” Executive Director of The Australia Institute, Ben Oquist said.

“It would be unfortunate for the PM to stand up today and declare that cutting taxes for the most profitable banks in the world is a priority, while making cuts to payments and services for those living on the brink.

“Even the PM doesn’t believe that it will ‘trickle-down’. Malcolm Turnbull recognized this prior to the election, when he remarked:

‘We cannot assume that the rising tide of economic growth will lift all boats – we have to make sure that it does.’

“During boom times, the Howard government was very profligate and most of the benefits of tax cuts and exemptions were the highest income earners. This is where a government committed to budget repair should be looking – at capital gains tax and superannuation concessions, in particular.

Income tax cuts announced in the pre-election Budget were also reserved for higher income earners only. While 34% of people in Malcolm Turnbull’s electorate of Wentworth earned enough for a tax cut, only 5-6% of people in many regional and outer-city electorates saw any benefit.

“One of the great achievements of Australia has been our egalitarian society. The ‘fair go’ has been the bedrock of our economic success and social cohesion,” Oquist said.

General Enquiries

Emily Bird Office Manager

Media Enquiries

David Barnott-Clement Media Advisor